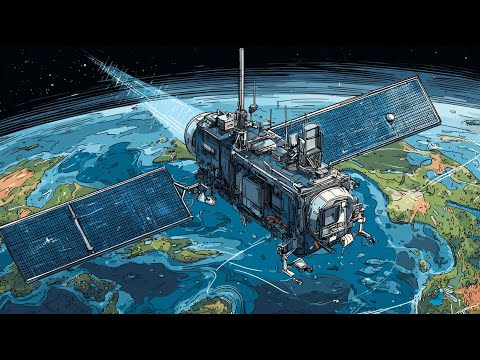

OneWeb Bankruptcy and Revival (2020)

March-November 2020What Happened

OneWeb, backed by SoftBank, filed for bankruptcy in March 2020 with 74 satellites deployed and $3.4 billion spent. The company had spectrum filings for 648 satellites but couldn't sustain launch costs. A UK government-led consortium acquired it for $1 billion in November, and the company eventually merged with Eutelsat in 2023.

Outcome

OneWeb's spectrum rights were preserved through the acquisition, allowing deployment to continue under new ownership.

Demonstrated that ITU filings alone don't guarantee deployment—financial viability and launch capacity matter more than regulatory priority.

Why It's Relevant Today

China's 200,000-satellite filing faces the same fundamental constraint: filings create options, but actual deployment requires sustained funding and launch infrastructure that may not materialize at the scale claimed.