1

FDA Approves, Launch Begins in Q1 2026

Discussed by: Industry analysts at CGTlive, Targeted Oncology, and oncology trade publications tracking first-half 2026 FDA decisions

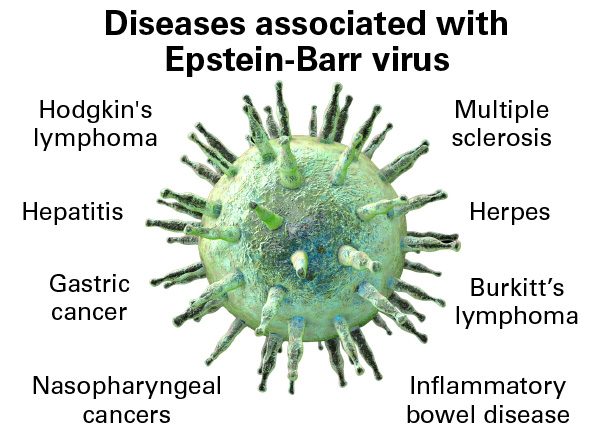

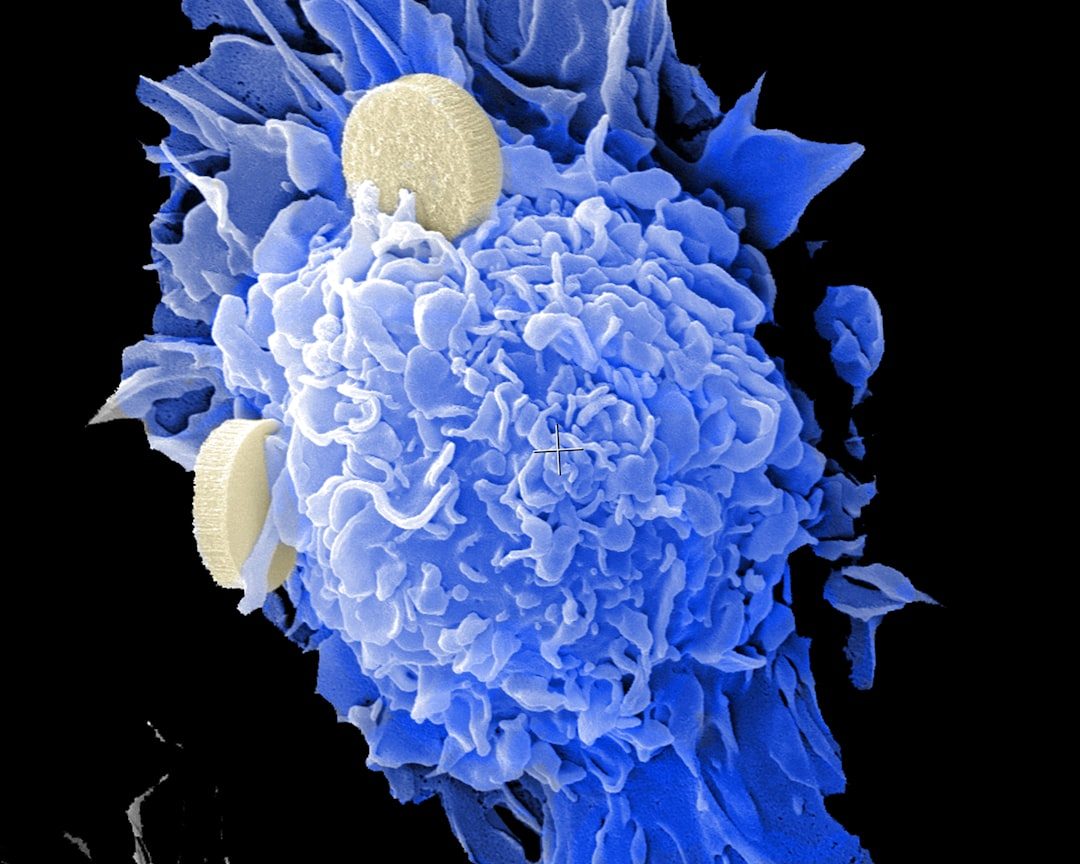

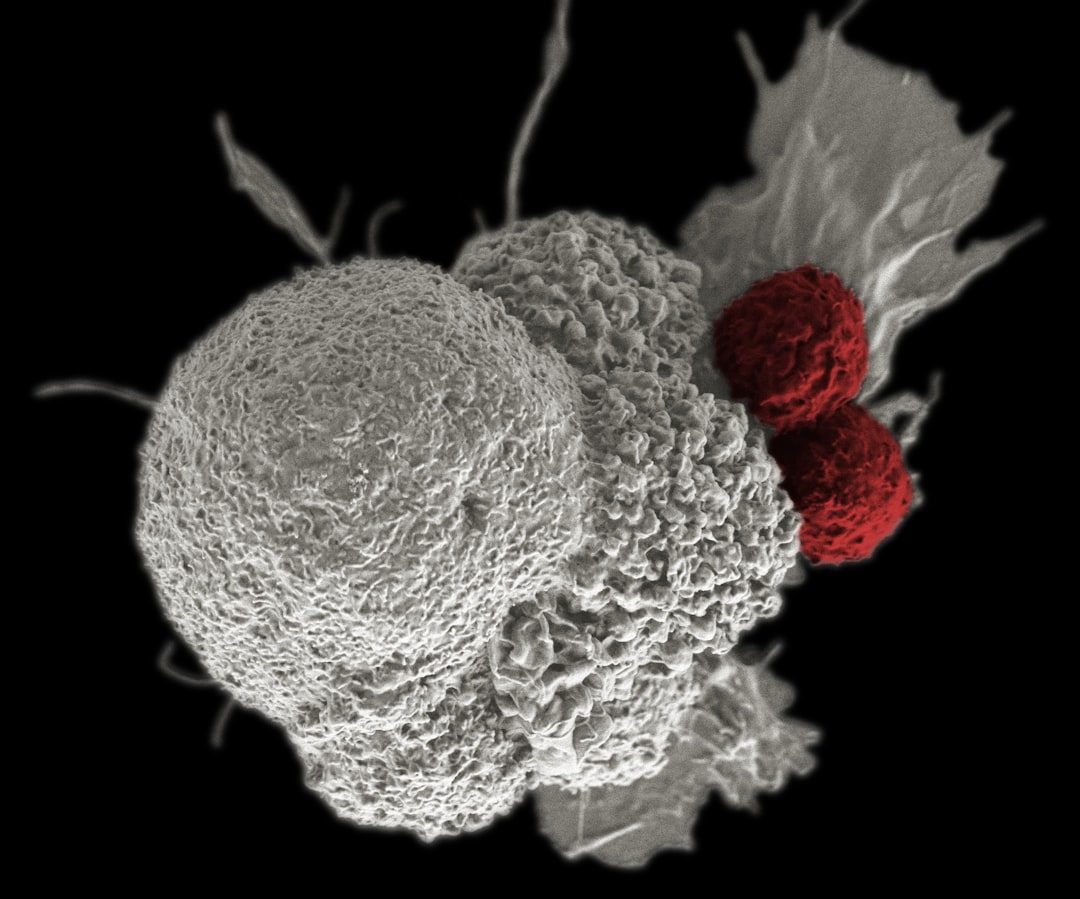

The FDA approves tabelecleucel, making it the first therapy for EBV+ PTLD after prior treatment. Pierre Fabre triggers a $40 million milestone payment to Atara and begins U.S. commercialization, building on European experience since 2022. The approval validates the off-the-shelf allogeneic T-cell therapy model, potentially opening pathways for other companies developing similar platforms. Given that the agency already confirmed no clinical or safety issues and manufacturing problems have been resolved, approval appears likely.

2

Second Complete Response Letter Delays Launch

Discussed by: Not widely predicted, but pharmaceutical industry observers note CMC issues caused 10+ cell therapy rejections historically

The FDA finds new chemistry, manufacturing, or controls deficiencies despite the facility fixes. This triggers another complete response letter, delaying approval 6-12 months while Pierre Fabre addresses additional requirements. The pattern parallels other cell therapies where manufacturing complexity led to multiple review cycles. Atara's stock would likely crater, and the Pierre Fabre partnership faces strain.

3

Conditional Approval with Post-Market Requirements

Discussed by: Rare disease regulatory specialists noting FDA's flexibility for orphan drugs with strong unmet need

The FDA approves tabelecleucel but mandates post-market surveillance studies or ongoing manufacturing monitoring given the earlier facility issues. This middle-ground approach gets therapy to desperate patients while maintaining oversight. The agency has used this path for other breakthrough therapies in rare diseases where clinical benefit clearly outweighs remaining uncertainties. Commercial launch proceeds but with strings attached.

4

Type A Meeting Yields Approval Pathway Without New Trial

Discussed by: Pierre Fabre in regulatory update; companies expressing hope for resolution in collaboration with patient advocates

The Type A meeting results in FDA agreeing to alternative analyses or supplemental data from existing studies rather than requiring a new clinical trial. The agency might accept additional post-hoc analyses of ALLELE data, real-world evidence from European use since 2022, or commitments for robust post-marketing surveillance. This would allow approval within 6-12 months without the multi-year delay of a new study. Given no safety concerns and the severe unmet need, FDA could find a middle path.

5

New Clinical Trial Required, 3+ Year Delay

Discussed by: Oncology analysts noting FDA's specific criticism of ALLELE study design and conduct suggests desire for different trial architecture

FDA insists on a new prospective study with different design—possibly randomized or with different endpoints—before reconsidering approval. This would require 2-3 years for enrollment and follow-up plus regulatory review time, effectively delaying U.S. approval until 2029 or later. The financial burden could threaten Atara's viability and test Pierre Fabre's commitment. The pattern mirrors other cell therapies where manufacturing issues masked deeper regulatory concerns about evidence quality.

6

Companies Abandon U.S. Market Pursuit

Discussed by: Not widely discussed but financial analysts noting Atara's limited runway and Pierre Fabre's options given existing European approval

After the Type A meeting reveals FDA's requirements are commercially unviable, Pierre Fabre decides to focus solely on European and other international markets where Ebvallo is already approved. Atara receives reduced milestone payments but maintains royalty stream from ex-U.S. sales. U.S. patients continue accessing therapy only through expanded access programs. This outcome becomes more probable if FDA demands expensive new trials for a small patient population.