Array Technologies IPO (2020)

October 2020What Happened

Solar tracker manufacturer Array Technologies went public on Nasdaq, pricing at $22 per share and raising $815 million. The stock doubled on its first day of trading, giving the company a $5 billion market cap—the largest solar IPO in U.S. history at that time.

Outcome

The IPO validated investor appetite for utility-scale solar infrastructure during the clean energy boom.

Array's stock fell over 70% from its 2021 highs amid supply chain disruptions and competition from Nextracker, illustrating the volatility of solar hardware valuations.

Why It's Relevant Today

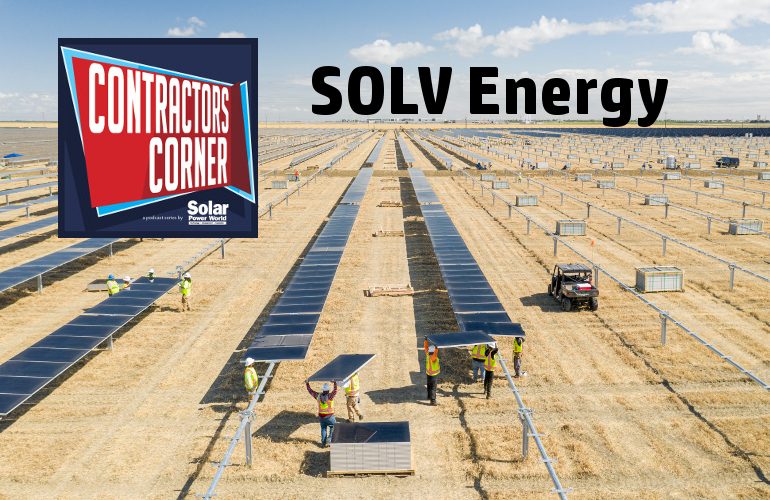

SOLV enters at a similar valuation ($4.7 billion) but with a service-based EPC model rather than hardware manufacturing, potentially offering more stable margins but similar policy exposure.