Great Recession Retail Collapse (2008)

September 2008 - June 2009What Happened

Retail sales fell for three consecutive months for the first time on record, dropping to 35-year lows. September 2008 saw a 1.2% decline—nearly double what economists expected. Furniture and electronics were hit hardest, down 2.3% and 1.5% respectively, as credit markets froze and unemployment spiked to 10%.

Outcome

Retailers slashed prices by up to 80% to clear inventory. Major chains including Circuit City and Linens 'n Things liquidated entirely.

Consumer deal-hunting became permanently ingrained, reshaping retail strategy around discounts and value positioning. Recovery to pre-crisis spending levels took three years.

Why It's Relevant Today

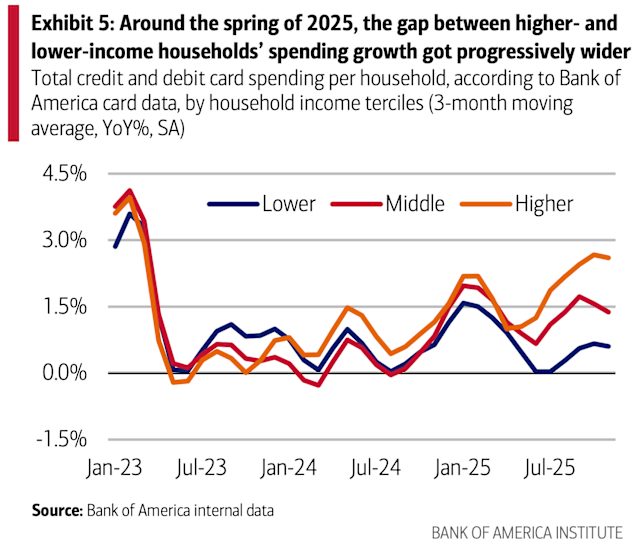

Today's flat December reading is not yet comparable—that was demand destruction from credit crisis, this is demand redistribution from income divergence. But the 2008 experience shows how quickly retail weakness can become self-reinforcing if confidence collapses.