CHIPS and Science Act (2022)

August 2022What Happened

Facing a similar concentration-of-supply problem in semiconductors — with 92% of advanced chips made in Taiwan — Congress passed the CHIPS and Science Act, committing $39 billion in manufacturing subsidies and a 25% investment tax credit to bring chip fabrication back to the United States. The law was a response to COVID-era chip shortages that had shut down auto factories and disrupted electronics production.

Outcome

Major chipmakers including Intel, TSMC, and Samsung announced over $200 billion in planned U.S. factory investments. The Commerce Department began distributing subsidies in 2024.

The law established a template for industrial policy as supply chain security, demonstrating that direct subsidies and tax incentives can attract manufacturing investment — though whether new plants will be cost-competitive without ongoing support remains unproven.

Why It's Relevant Today

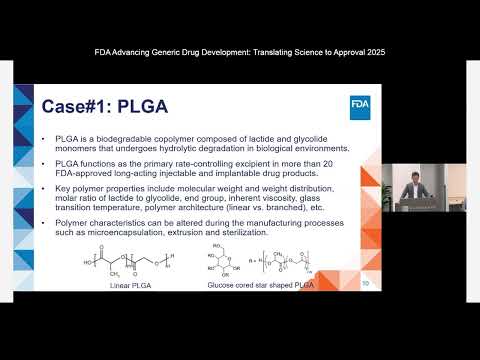

The FDA's onshoring toolkit uses regulatory incentives and fee waivers rather than the tens of billions in direct subsidies that the CHIPS Act deployed. Whether the pharmaceutical approach — lighter on funding but tailored to the industry's specific regulatory bottlenecks — can produce comparable results is the central policy experiment.