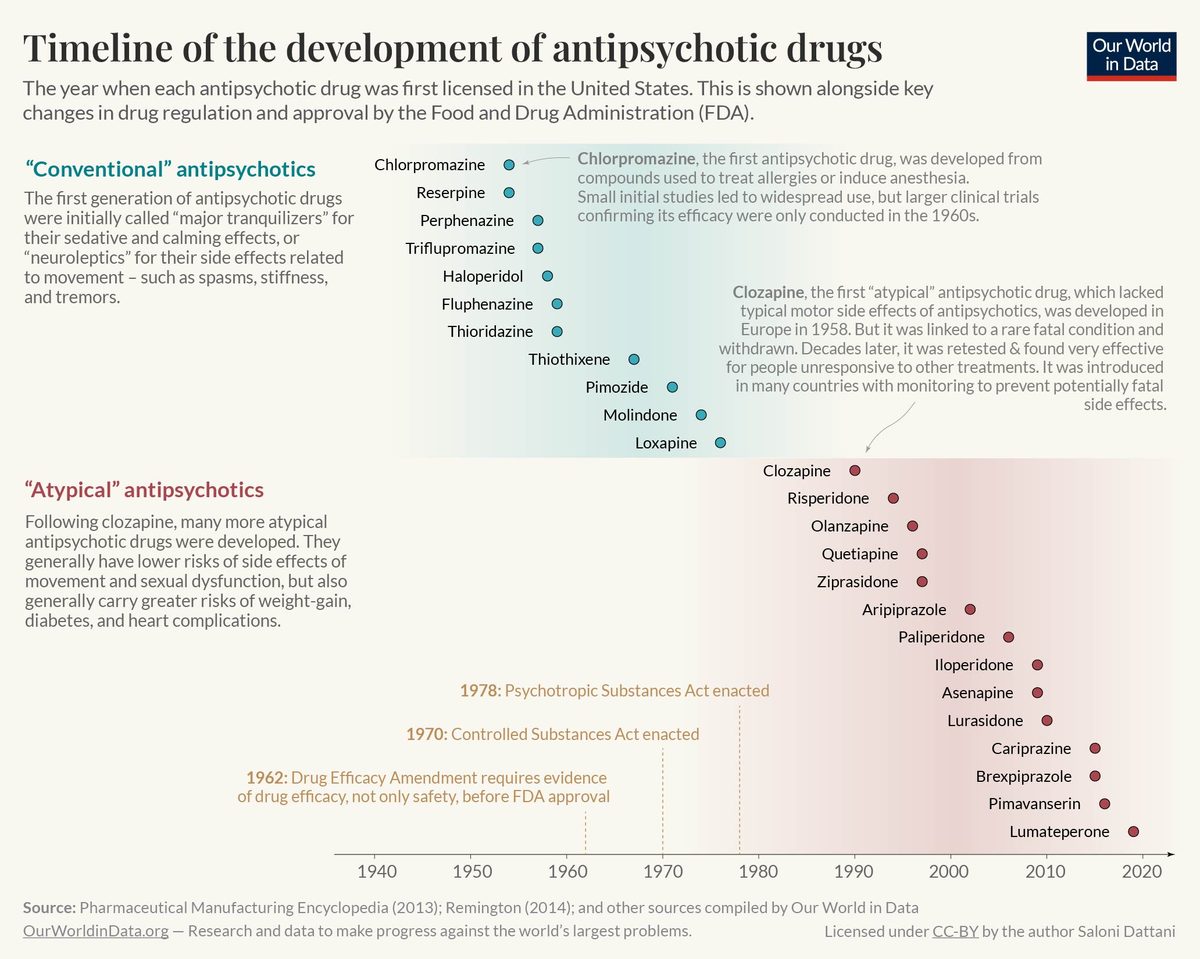

Clozapine reintroduction (1989)

February 1989What Happened

The FDA approved clozapine—first synthesized in 1959—for treatment-resistant schizophrenia, 14 years after it was withdrawn from the European market when eight Finnish patients died from a dangerous drop in white blood cells. The approval came with an unprecedented mandatory blood-monitoring requirement, a compromise that gave patients access to the only drug proven effective when others failed.

Outcome

Clozapine's reintroduction demonstrated that a drug with serious risks could still reach patients if monitoring systems were put in place. It immediately became the treatment of last resort for the most difficult schizophrenia cases.

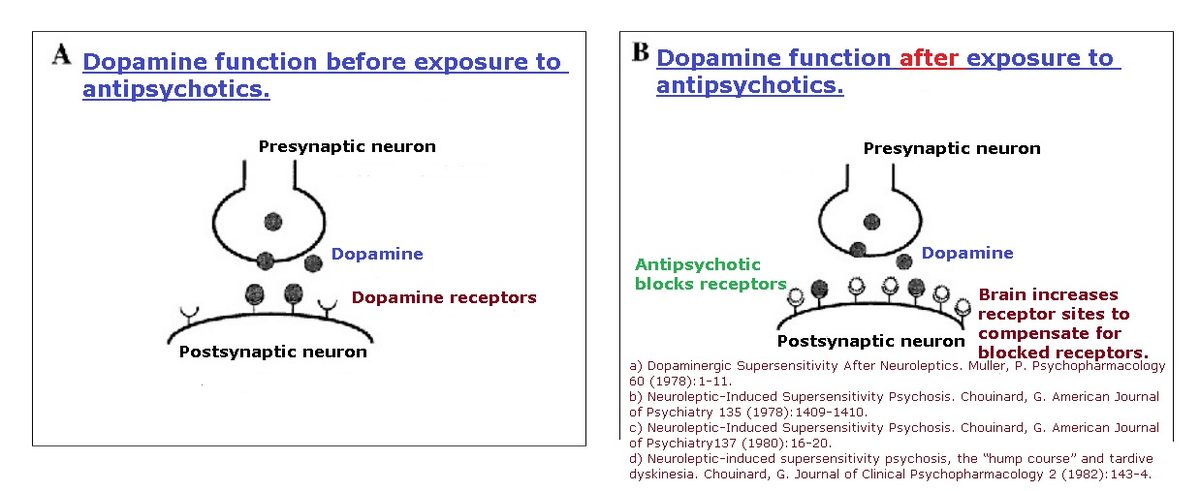

Clozapine's success launched the atypical antipsychotic era. Every major antipsychotic approved in the following 35 years—risperidone, olanzapine, quetiapine, aripiprazole, and others—used some variant of dopamine and serotonin receptor blocking. That paradigm held until Cobenfy broke it in 2024.

Why It's Relevant Today

Bysanti sits within the atypical antipsychotic tradition that clozapine began. Its approval shows this class of drugs is still expanding, even as fundamentally new approaches like Cobenfy emerge.