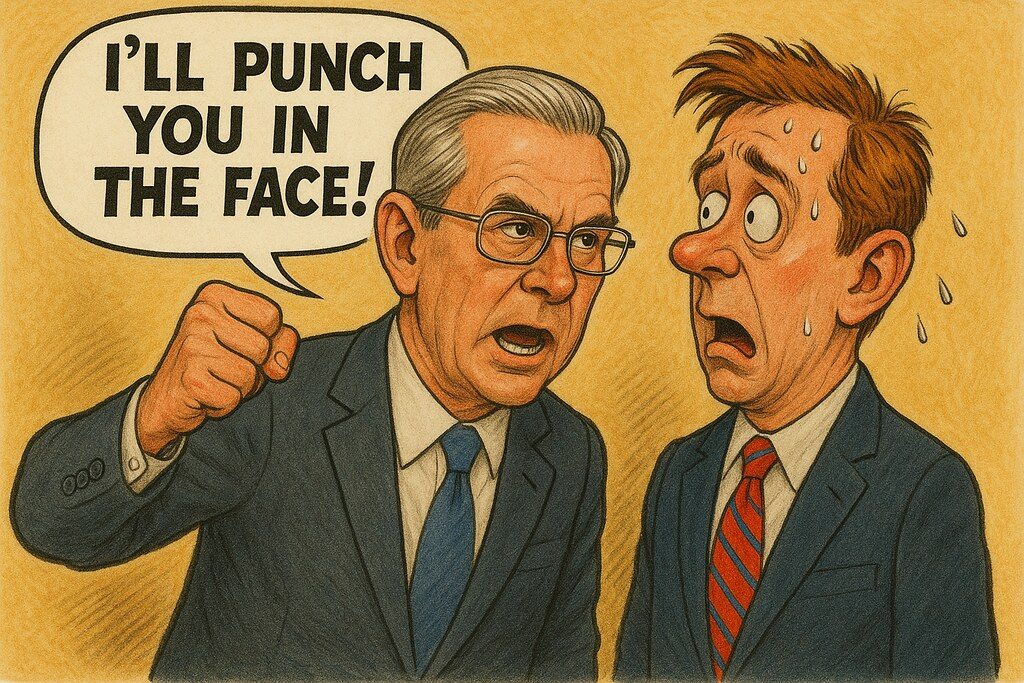

Treasury Secretary Scott Bessent's February 2026 congressional testimony shattered norms of Treasury oversight: two days of shouting matches with House Democrats (Maxine Waters asking to 'shut him up,' Gregory Meeks calling him a 'flunky'), followed by heated Senate Banking Committee exchanges where Democratic Senator Jack Reed called his conduct 'childish' and Senator Elizabeth Warren pressed him on whether Fed nominee Kevin Warsh would face investigations if interest rates aren't cut as Trump demands. Bessent refused to clarify, prompting Warren to call the situation 'an even taller steaming pile of corruption.' The hearings devolved into what one former Treasury official called a role 'you typically don't see a treasury secretary play.'

The confrontations centered on three pressure points: tariffs economists say add $9,200 to a typical new home, a $500 million stake a UAE royal took in the Trump family's crypto firm days before inauguration, and whether the Community Development Financial Institution fund will continue financing affordable housing. On February 5, Rep. Ro Khanna launched a formal House investigation into World Liberty Financial, citing potential conflicts of interest and national security risks. Ethics experts and even GOP megadonor Ken Griffin have warned the UAE deal is 'categorically different' from prior Trump family conflicts and 'fundamentally compromising of our foreign policy.' With Trump's economic approval at 36% and affordability dominating voter concerns ahead of the 2026 midterms, Bessent's combative posture and the expanding crypto investigation signal the administration has chosen political combat over traditional Treasury neutrality.