Kenya's M-KOPA Mobile Solar Revolution (2012-Present)

October 2012 - PresentWhat Happened

M-KOPA launched in Kenya in late 2012, pioneering pay-as-you-go solar home systems financed through mobile money. By 2018, the company had electrified 500,000 homes across East Africa. The model worked because M-Pesa mobile payments reached 80% of Kenyan adults, grid electricity was expensive, and daily micropayments fit household budgets.

Outcome

Kenya became the global leader in pay-as-you-go solar penetration, with over 1.2 million households using solar home systems.

The model proved that off-grid solar could scale commercially in developing markets, spawning imitators across Africa and Asia.

Why It's Relevant Today

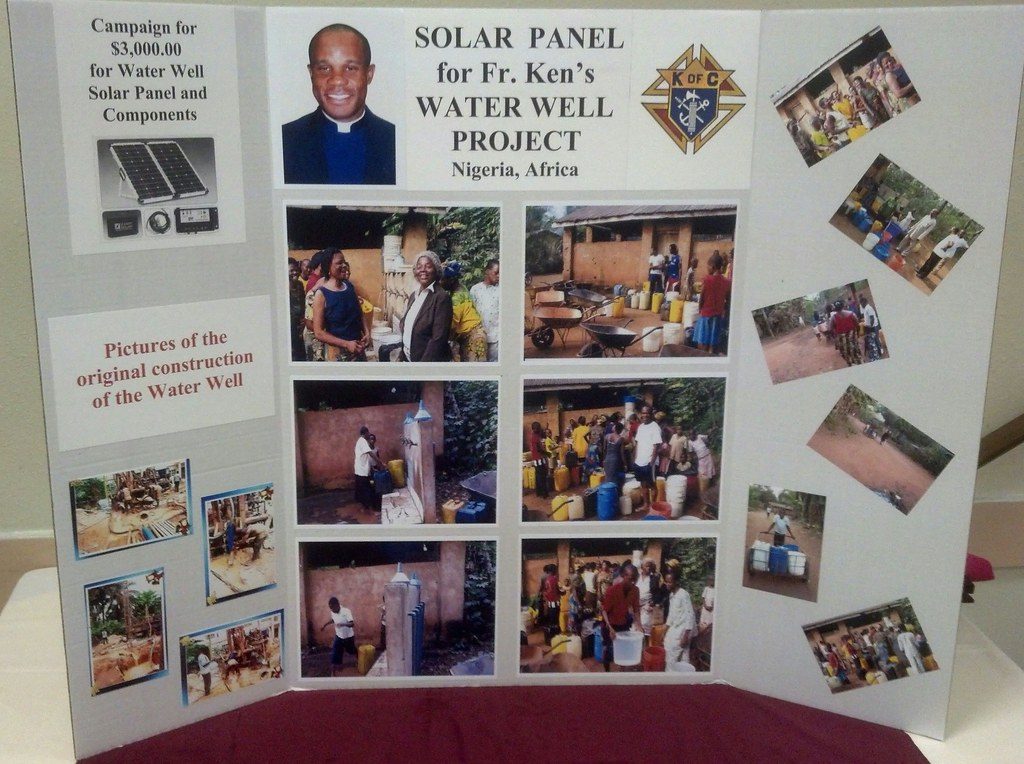

Nigeria is attempting to replicate Kenya's success with companies like Lumos (partnered with MTN for mobile payments) and Arnergy. The challenge: Nigeria's mobile money ecosystem is less developed than Kenya's M-Pesa network, requiring different financing approaches.