U.S. Uranium Enrichment Privatization (1998)

1998What Happened

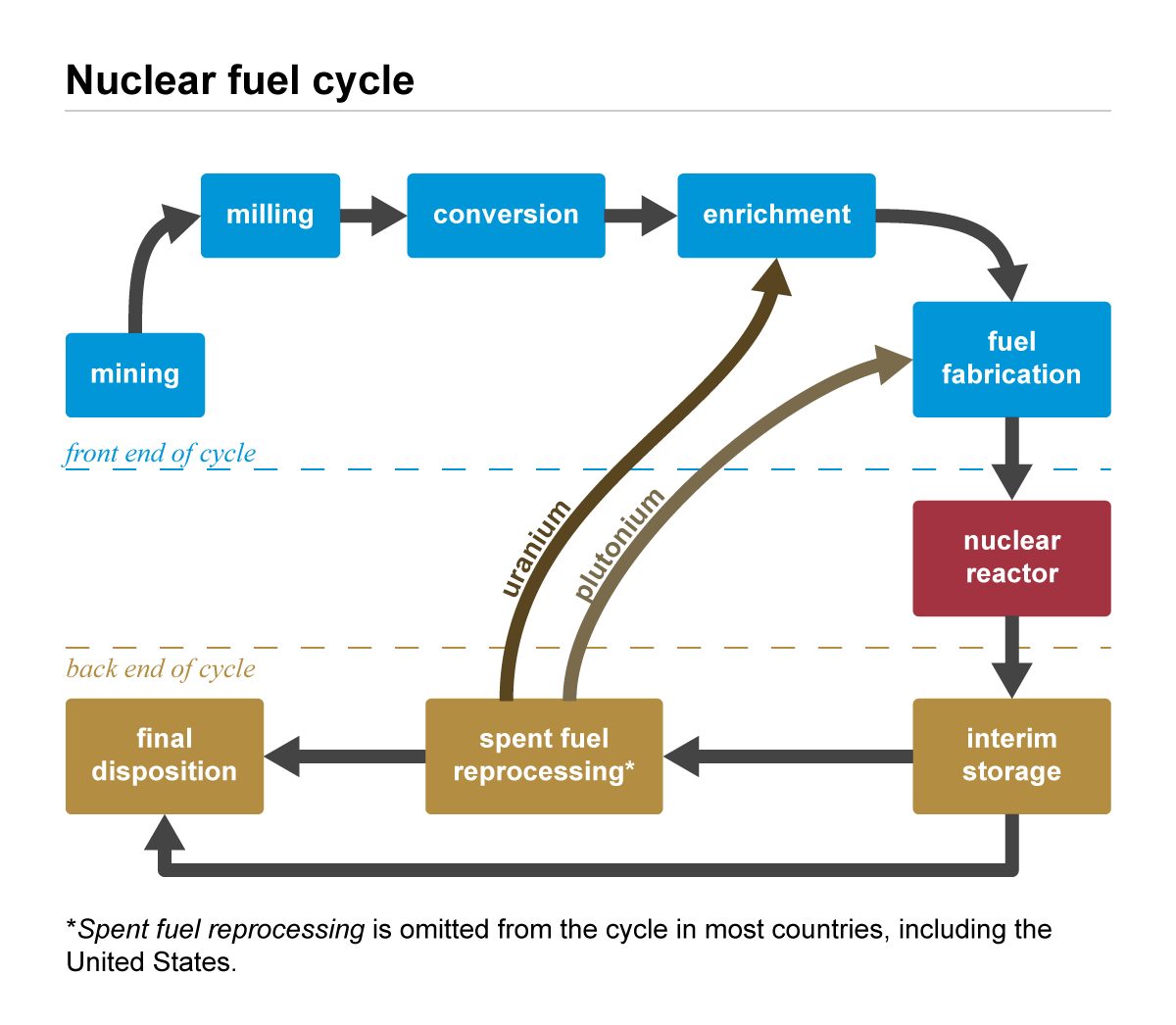

The U.S. government privatized its uranium enrichment operations, creating the United States Enrichment Corporation (USEC), later renamed Centrus Energy. For decades prior, the government had maintained strategic control over enrichment at facilities in Oak Ridge, Tennessee, and Paducah, Kentucky. The gaseous diffusion plants were energy-intensive and ultimately uncompetitive.

Outcome

USEC became a publicly traded company, but struggled to compete with foreign enrichers using more efficient centrifuge technology.

The U.S. lost domestic enrichment capacity as aging plants closed, leading to dependence on foreign suppliers including Russia's Rosatom.

Why It's Relevant Today

The current $2.7 billion government investment represents an attempt to reverse the strategic mistake of allowing domestic enrichment capability to atrophy after privatization.