Western Australia's Gas Reservation Policy (2006)

October 2006 - PresentWhat Happened

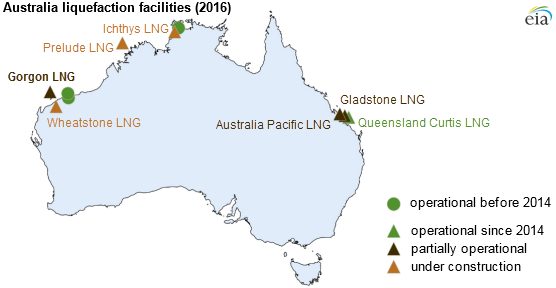

Western Australia formalized a requirement that LNG export projects reserve 15% of production for domestic use. The policy gave the state government leverage over major projects like Gorgon and Wheatstone, requiring domestic supply commitments as a condition of state agreement approvals.

Outcome

Producers complied, building domestic gas infrastructure alongside export terminals. WA maintained plentiful, relatively affordable gas.

The state has avoided the shortfalls plaguing the east coast. However, enforcement proved difficult—by 2024, exporters were delivering only about 8% domestically, prompting reforms to strengthen the 15% requirement.

Why It's Relevant Today

East coast states never implemented equivalent reservation requirements before LNG exports began. The Taroom Trough's 'Australian Market Supply Condition' represents Queensland's attempt to secure domestic-first supply without a formal reservation policy.